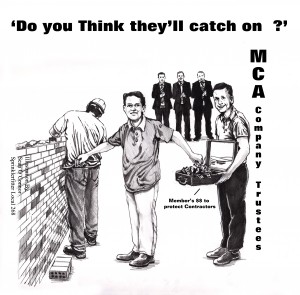

Sleight-of-hand’ plan to siphon off $1.38 of members $$$ to benefit contractors

Part 1: Killing members’ pension plan for contractors’ benefit

By ED FINKELSTEIN

Publisher

In just-begun contract negotiations with Bricklayers Local 1, mason contractors pension trustees are attempting a sleight-of-hand move on the Bricklayers’ pension plan that will have serious, long-term negative consequences for future retirees, warned Local 1 Business Manager Don Brown.

The management trustees with the Mason Contractors Association (MCA) want to make a major change to the union’s current defined benefit pension plan that will be “detrimental to all bricklayers in a big way,” said Brown. The union is holding firm, refusing to make the change.

MCA trustees want to kill the current defined benefit pension plan, freeze benefits at current levels, and replace the defined benefit plan with a defined contribution plan similar to a 401(k). (See related story on Page 12 on the differences between the two plans.)

Brown says the contractors want to split the $4.60 an hour contribution into the current pension plan into what would become the current terminated/frozen plan and $3.22 going into a proposed new 401(k) type plan.

BRICKLAYER PENSIONS ‘IN THE TRASH’

Brown says there are major cracks in the foundation of the mason contractors’ plan:

• Current members: The $1.38 an hour that would be siphoned off to go into the terminated/frozen plan would earn bricklayers NO additional credits/benefits in their pension. If the current plan is terminated, pension benefits will be frozen at the current levels, despite the fact that bricklayers would still paying into the terminated plan.

“It’s simple,” says Brown: “Money into a dead plan, no benefits for our members.”

• Apprentices: Except for first-year apprentices that are not covered by the pension, bricklayer apprentices will be contributing $1.38-an-hour into a terminated plan from which they will never gain any credits/benefits.

• Future journeymen: Once a current or future apprentice becomes a journeyman, they are not eligible for any additional benefits from the terminated plan although they have been, and will continue to have $1.38-an-hour siphoned off their benefit package to be paid into the terminated/frozen plan.

•For everyone: If the MCA is able to force this change on the current Pension Fund, members’ money invested in the proposed new 401(k) style plan could be wiped out if there is another financial crash. Unlike a defined benefit plan, there are no guarantees of a pension with a defined contribution plan. Although a professional financial advisor would invest these monies in stocks and bonds, each member’s account would be subject to the ups and downs of the stock market.

“A bricklayer could work all his life and if the stock market goes badly, their retirement is in the trash. We can’t let that happen,” Brown stressed.

IT’S THE MEMBERS’ MONEY

Why do the MCA trustees want to make this change so badly? To protect MCA contractors against any future unfunded liabilities from the terminated plan.

Federal law requires that companies participating in a defined benefit pension plan are financially liable for future benefits to be paid out, even if there’s not enough money in the pension plan to pay those benefits. This is called the “unfunded pension liability.” It’s a huge problem in pension plans across the nation.

With a defined contribution plan, there is no withdrawal liability because that type of plan does not guarantee any benefits.

In other words, the MCA Trustees want to freeze the defined benefit plan and require it to be funded with members’ money to ensure that there is no withdrawal liability for the contractors.

But Brown says the $1.38-an-hour is money bricklayers gave up as part of their salary in order to have money for their retirement. Siphoning that money off into a terminated plan is nothing more than using the members’ money to protect the contractors from unfunded liabilities, which the union feels strongly is unfair to its members.

“We want to be reasonable with our contractors. After all, they provide the work for our members. However, we can’t let them take money from our members’ pockets as an insurance policy for themselves,” Brown said.

CONTRACTOR FEARS UNFOUNDED

And Brown says the MCA Trustees’ fears of withdrawal liability are unfounded.

The Pension Fund’s actuary says the current funding and contribution levels are more than adequate to keep the Plan fully funded for the next 15 years.

While unfunded defined benefit plans are a problem, the Bricklayers Pension Plan enjoys a unique position: the plan is 97.5 percent funded and has NO unfunded pension liabilities.

This means that the Pension Fund is in the “green zone” under federal law, which is the gold standard in pension fund safety. Underfunded plans fall into one of four other categories: yellow (endangered); orange (seriously endangered); red (critical); and the worst, critical and declining.

In each of these categories except the green zone, contractors/business owners may owe substantial amounts in withdrawal liability.

The union’s current four-year contract expires May 31. Negotiations only began on April 14.

[box style=”5″]

‘Defined’ vs. ‘contribution’ pension plans

could make a big difference at retirement

Bricklayers Local 1 is fending off an effort by its contractors to radically change their pension program by killing off the current defined benefit plan and replacing it with a defined contribution plan.

Here are the two big differences for workers:

• A defined benefit pension plan guarantees participants a specific level monthly dollar benefit determined by their length of service upon retirement. This specific benefit is paid every month regardless of the plan’s investment performance.

• A defined contribution plan guarantees no level of monthly benefits. Instead, dollars are put into a 401(k) style plan in each participant’s name. The Trust Fund’s investment advisors then invest those funds. As a result of those investments, the individual’s account could see solid growth OR it could see substantial losses, just like the stock market since most of the plan’s investments are in the stock market. Once the participant retires, they are entitled to the balance of money left in their individual account.

In other words, under a defined contribution plan, a member approaching retirement could be forced to continue working, or take a significant financial hit, if the stock market takes a dramatic downturn close to their projected retirement date.