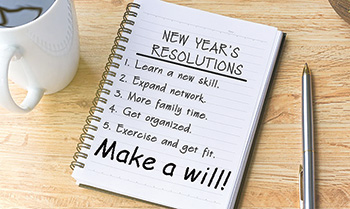

The new year often brings with it new resolutions. If you have an estate plan, resolve to have your plan undergo a checkup and ensure that all of the pieces that work together to comprise your total estate plan are up to date and consistent with your current wishes.

The new year often brings with it new resolutions. If you have an estate plan, resolve to have your plan undergo a checkup and ensure that all of the pieces that work together to comprise your total estate plan are up to date and consistent with your current wishes.

This is especially true as we deal with the effects of COVID-19. Whether you’ve experienced deaths, births, divorces, marriages or other events, a life event like the pandemic can change your circumstances and may mean making alterations to your plan is in order. Simply checking up on your will and trust is not enough; you should also make sure that your powers of attorney, living will and non-probate accounts are also current with your existing estate-planning goals.

If you haven’t created an estate plan, you should resolve to do so. If you have, make getting an estate plan review one of your resolutions.

PUT YOUR AFFAIRS IN ORDER

Pandemic or not, having your affairs in order is very important, according to St. Louis law firm TuckerAllen, which offers alternatives to in-person meetings.

“We can complete an estate plan in as little as two sessions – the initial consultation and the signing conference. Neither have to be done in person,” said Missy Shands Manning, an estate planning attorney at TuckerAllen,

“For those who are not comfortable with video conferencing, or do not have the necessary equipment, we offer initial consultations over the phone to get the information we need to customize our clients’ estate plans.

“In addition to virtual signings, we offer drive-up signings where the client signs the documents in the car where we can see them, as well as social distancing signings, if they prefer to come inside and ask questions to face-to-face. The process is simple and we offer flat-rate pricing in these uncertain times. We even offer a 12-month interest-free payment plan in case money is tight right now for clients,” Manning noted.

WHY HAVE AN ESTATE PLAN?

Making sure that your plan is up to date involves more than just checking your will or living trust. An unexpected death may impact your powers of attorney if the departed was one of the agents you named under those documents. Altering or replacing these documents to ensure that you still have an ample number of agents and backup agents can ensure that these powers will work the way you want should they be needed.

According to TuckerAllen, a proper estate plan will provide for a person’s sickness and incapacity, as well as death.

Your estate plan should include:

- A health care power of attorney nominates someone to make health care decisions when you are sick. This includes hiring and firing doctors, moving hospitals, and authorizing or withdrawing medical procedures.

- A general power of attorney nominates someone to make personal and financial decisions when you are incapacitated. This includes paying your bills when you are in the hospital, moving you into or out of a nursing home, and opening your mail.

- A health care directive (also called a “living will”) tells your family and medical professionals whether you want to “pull the plug” or continue to receive life-prolonging treatment if you enter a vegetative state and are unlikely to ever recover.

- A HIPAA waiver tells health care facilities who they may share your protected health care information with. For example, a family member may want to call in and get an update on your health since in-person visits are forbidden. These are especially important if a patient has a significant other, a blended family, or family strife.

AVOIDING PROBATE

One last thing: By setting up an estate plan, people get to choose where their money should go upon their passing instead of letting the state government decide according to its intestacy (inheritance) laws.

A little bit of money now to set up an estate plan will save clients’ families thousands of dollars in the future by avoiding probate, says TuckerAllen’s Manning. Probate is the process where the county circuit court oversees the distribution of a deceased person’s assets.

For more information, contact the TuckerAllen estate and elder law firm at 314-335-1100. The office is located in Kirkwood at 1001 S. Kirkwood Road, Suite 130.