By KATHLEEN ROMIG

By KATHLEEN ROMIG

This summer’s budget deal between President Trump and congressional leaders offers enough total discretionary dollars to give the Social Security Administration (SSA) a much-needed funding boost in 2020, but the Senate majority plans to cut $2.7 billion in inflation-adjusted dollars from the appropriations bill that funds SSA operations. That bill, in turn, would reduce SSA funding by more than two percent in inflation-adjusted terms.

The companion House bill would slightly increase SSA funding, but by barely enough to offset inflation in 2020 — and not nearly enough to offset years of underfunding before then. For SSA to provide high-quality service to a growing population, policymakers must boost funding substantially.

The companion House bill would slightly increase SSA funding, but by barely enough to offset inflation in 2020 — and not nearly enough to offset years of underfunding before then. For SSA to provide high-quality service to a growing population, policymakers must boost funding substantially.

SSA’s years of cuts have taken their toll.

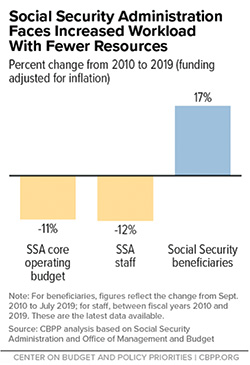

From 2010 to 2019, its operating budget fell nearly 11 percent in inflation-adjusted terms — even as the number of Social Security beneficiaries grew by 17 percent. (See chart.) As a result, SSA has lost 12 percent of its staff since 2010, hampering its ability to perform its essential services, such as determining eligibility in a timely manner for retirement, survivor and disability benefits; paying benefits accurately and on time; responding to questions from the public; and updating benefits promptly when circumstances change.

WORKLOADS AND COSTS GROW, BUDGETS AND STAFFING SHRINK

As workloads and costs have grown — and budgets and staffing have shrunk — SSA’s service delivery has worsened:

- Most callers to SSA’s national 800 number don’t get their questions resolved; as callers are on hold for longer periods, nearly half hang up before connecting. And a growing number get busy signals.

- Due to understaffing, field office wait times have risen in every region of the country since 2010, with millions of visitors waiting longer than an hour.

- SSA has been forced to close 67 field offices and shorten office hours in the rest, making it harder for taxpayers and beneficiaries to access service.

- The average wait for a disability appeal is 16 months, causing hardship for hundreds of thousands of workers already struggling with a life-changing disability.

- SSA has stopped mailing Social Security statements to most workers as legally required, citing budget constraints.

- Millions of beneficiaries await benefit adjustments due to the agency’s backlog on its behind-the-scenes work, such as awarding benefits to widows when spouses die, issuing back payments, resolving complex claims issues, and adjusting benefits for early retirees and disabled workers with earnings. Some 3.2 million of these actions are pending, causing unnecessary hardship — and often overpayments.

INCREASED WORKLOAD WITH FEWER RESOURCES

SSA’s extremely tight budgets have been driven by two factors:

- The 2011 Budget Control Act’s tight annual caps on total discretionary funding.

- Policymakers’ failure to give SSA its fair share of funding increases from past budget deals that raised those caps on a temporary basis. For example, the budget deal for 2018 provided a nine percent increase in non-defense discretionary (NDD) funding from the previous year in inflation-adjusted terms, but SSA’s budget rose only two percent. NDD spending rose nearly one percent in inflation-adjusted terms in 2019, but policymakers cut SSA’s budget by almost two percent, which helped convince SSA Commissioner Andrew Saul to impose a partial hiring freeze.

Annual funding bills for the departments of Labor, Health and Human Services, and Education, which also include SSA’s administrative budget, have faced large cuts since 2010. The President and Congress should provide sufficient funding in the final 2020 appropriations bill to cover SSA’s essential services.

(Kathleen Romig is a senior policy analyst at the Center on Budget and Policy Priorities. She works on Social Security, Supplemental Security Income and other budget issues. Romig previously worked at the Social Security Administration, Social Security Advisory Board and Congressional Research Service. Reprinted from Truthout.)