Members of the House Budget Committee questioned Missouri Department of Revenue Director Joel Walters Jan. 23 over incorrect income tax withholding tables the agency provided to employers last year that will result in potentially hundreds of thousands of Missourians getting hit with unexpected tax bills in the coming weeks.

Members of the House Budget Committee questioned Missouri Department of Revenue Director Joel Walters Jan. 23 over incorrect income tax withholding tables the agency provided to employers last year that will result in potentially hundreds of thousands of Missourians getting hit with unexpected tax bills in the coming weeks.

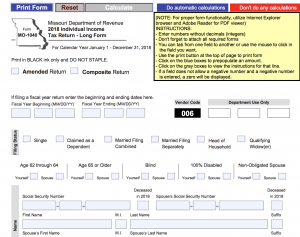

Businesses rely on the withholding tables to determine how much money to take out of employee paychecks for state and federal income taxes. While a calculation error the department discovered in the tables in September contributed to the under-withholding issue, Walters said changes in federal tax law that took effect last year also were a major factor.

No Missourian’s overall tax liability increased due to the withholding error. However, because not enough money was taken out of many Missourians’ paychecks last year, those affected could end up owing the state more than anticipated when the fill out their tax returns in the coming weeks.

The overall statewide impact is expected to be significant. As of Jan. 22, year-to-date state general revenue collections for the 2019 fiscal year, which runs through June 30, were down by more than $500 million compared to what they were in FY 2018.

However, Walters said the revenue department remains confident the state will make up that half-billion shortfall when Missourians begin filing their income tax returns.