Finally, help is coming

By ED FINKELSTEIN

Publisher

Relief is on its way – at last.

President Joe Biden signed the American Rescue Plan – $1.9 trillion COVID-19 relief package for America’s working families – on March 11, sending much-needed economic recovery assistance to families, cities and businesses impacted by the coronavirus.

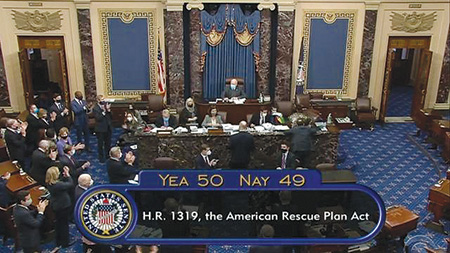

The revised relief package passed in the Senate March 6, along a strictly party-line vote. Democrats voted unanimously to pass the desperately needed relief package, but every Republican voted against it. (That’s something to keep in mind in the next election if you are among those receiving a $1,400 relief check – not a single Republican wanted you to have it.) The House approved the plan on March 10 and sent it to Biden.

WHAT’S IN THE RESCUE PLAN?

Here is a summary of benefits proposed in the revised Senate bill:

CASH IN YOUR POCKET

The bill includes direct payment of:

- $1,400 for individuals earning an adjusted gross income of up to $75,000, on top of the $600 payment from last December’s stimulus bill.

- $2,800 for couples filing joint tax returns and earning up to $150,000 (or $112,500 for heads of households).

- An additional $1,400 for each dependent claimed on a family’s most recent tax filings. While 17 was the previous cutoff, dependent college students, disabled adult children, or an adult parent under their family’s care will qualify for the $1,400 dependent payment.

UNEMPLOYMENT BENEFITS

• Extends $300 weekly federal unemployment supplement through Sept. 6, and makes the first $10,200 received in 2020 non-taxable for households making under $150,000.

WHAT DO YOU NEED TO DO?

At this point, the IRS will probably issue advance payments either based on your 2019 federal return or your 2020 return if you have filed one already.

If your income was too high for a payment based on your adjusted gross income for 2019 but you think you may be eligible based on your 2020 income, you should file your tax return as soon as you can.

WHEN WILL STIMULUS PAYMENTS ARRIVE?

Two days after the second stimulus package was signed into law on Dec. 27, providing $600 payments to eligible Americans, the IRS began making direct deposits to eligible recipients’ bank accounts. A day after that, on Dec. 30, the agency began mailing paper checks. A similar timeline is expected for this round of relief.

HOW WILL YOU GET THE MONEY?

In previous rounds, the IRS issued payments either by direct deposit, a mailed check or prepaid debit card. There is no guarantee your payment will be delivered the same way this time as it was for the December package. If you received payment through direct deposit previously, you may get a check this time, or the IRS could send payments on a prepaid debit card.

(Information from CNBC and the Washington Post.)